The quantities at which layoffs were carried out this year at every level was astounding, Big tech companies combined have laid off more than 50,000 people and are still firing, not just new joiners’ but even highly paid executives. This has invited a lot of criticism from the press and the masses. The mentioned companies stated that they are firing due to the impending recession they foresee, the economic recession is affecting every individual, from fluctuating interest rates implemented by central banks, rising prices on commodities which is hard on the finances of the average individual making a living. What is this “recession” word that is being thrown around? Is there a way around to prevent recession from happening?

Crucial Fundamentals to Discern

The dictionary definition of recession states it is an economic decline in which trade and industrial activities are reduced, which results in the fall of GDP, this fall of GDP for two consecutive quarters is dubbed as recession. Before we know what causes a recession, we need to know what GDP is, GDP (Gross Domestic Product) is the standard measure of the volume added created through the production of goods and services in a nation during a specified period. It is basically whatever every individual in the entire country buys and sells, be it goods or services, all expressed as a percentage. GDP is the most revered statistic of the country, it shows how well the country is progressing or declining economically.

A Simple Example- The Baker and his Bread

A Simple Example- The Baker and his Bread

This is best explained with an example, Let us consider a bakery in a town with one employee, and he has bread priced at SGD 2, and his business is functioning well, lot of people are buying from the baker, business is doing well, with all the additional profits he hires new people to help him, and the price of flour increases due to poor yield that year, so the baker increases the price of the bread to SGD 3, When this happens the regular people who were buying from the baker decide to stop buying as they feel the price is too much, or maybe the bread is not worth the price, so when this happens the business of the baker comes to a standstill, overtime it turns into losses and he can’t afford to pay his employees, so he fires them, and this creates a butterfly effect, the fired employees who have families will start to spend less, therefore they buy less goods, and the other stores will witness lesser sales, the baker will start to buy less flour from the merchants, and the merchant will lower his orders, and this will impact every other business as people become conscious of they spend money, the entire town will witness less spending.

Take-Away From the Example

Now Let us take the above small-town example and apply it to the size of the nation, It is understood the trigger can be arbitrary, which will set off a chain of events that impacts every sector which are all interconnected for smooth operations. Recession is a macroeconomic factor that is caused by the minutiae decisions every individual makes according to his or her economic stature and when applied at a macroeconomic scale of a large population, the snowball effect manifests itself. When the amount of goods and services a nation produces isn’t being equally consumed, it results in tremendous losses for the ones producing those and to cut costs they downsize the workforce, while people lose their purchasing power.

The Counters to Balance the Scale

The first organization to act to remedy this is the banks, they are one of the institutions that are hit the most in this period, they need to make sure the money starts flowing into the economy again, after calculating they come up with a good number to lower the interest rates so people are incentivized to borrow and at the same time giving investors security, as the interest rates become less, businesses and individuals have the ease of borrowing and repaying thanks to the aforementioned rates, this loan allows them to get their businesses back on track.

For the Predictable Future

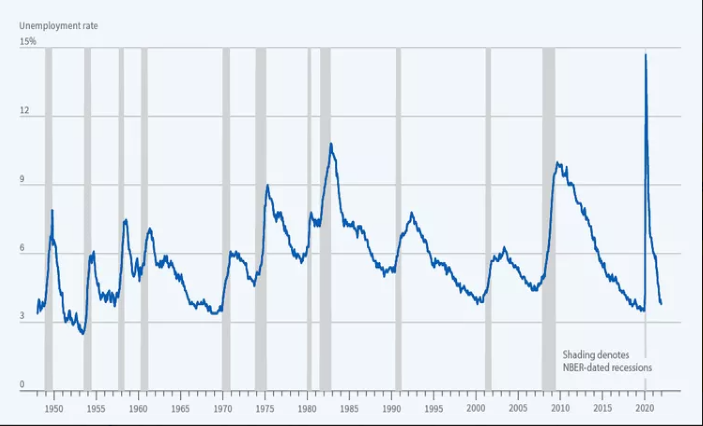

Ever since the great depression, USA has witnessed 14 recessions, with 2007-2009 being the longest one. If we were to analyze the graph below which was released by the NBER, it is observed recession is always accompanied by peak unemployment, the drop is proportional to the rise in the prior economic stage.

Is the recession a periodic event in the current economic system? Is our capitalistic economic system flawed which can’t be rectified? Is there a remedy to this or should we accept this as a flaw like every human-designed system? Is the recession we witness nearly every decade unavoidable? The current economic system is an extremely well-oiled machine, when a single component breaks down, the entire machine stops working, and the longer we take to fix it, the more work we miss, similar to the economic system, the later we take action, the more economic decline we witness.

We use cookies to ensure you get the best experience on our website. Read more...